Buying your very first house is a phenomenon packed with excitement and you will expectation, nevertheless procedure may end up being challenging and sometimes outright scary. Fortunately having potential housebuyers into the Georgia, there are numerous apps offered to assist basic-day homebuyers see the procedure and even help with brand new earnings.

Brand new U.S. Institution out of Homes and Urban Innovation (HUD) also provides guidance properties to aid very first-day homebuyers most useful see the homebuying techniques. HUD-acknowledged counseling enterprises render all of these characteristics for free. Particular companies provide on line education programs which, in the event that accomplished, can help you availability certain first-time homebuyer financing applications.

Is eligible for so it income tax borrowing from the bank you really must be buying a home into the a beneficial focused city

- Georgia FHA Money: This type of funds is actually insured by the Federal Construction Government plus they render basic-time homeowners an easily affordable down-payment (step 3.5%). But not, consumers will have to pay for financial insurance coverage (MIP) and that serves as coverage for the financial if you default to the the loan. Loan restrictions will vary considering county and are usually cash advance in Mcdonald Chapel determined predicated on the fresh new average domestic rates regarding area. When you are there are no earnings restrictions so you can be eligible for a keen FHA financing, try to meet with the financial obligation-to-money rates greeting of the FHA.

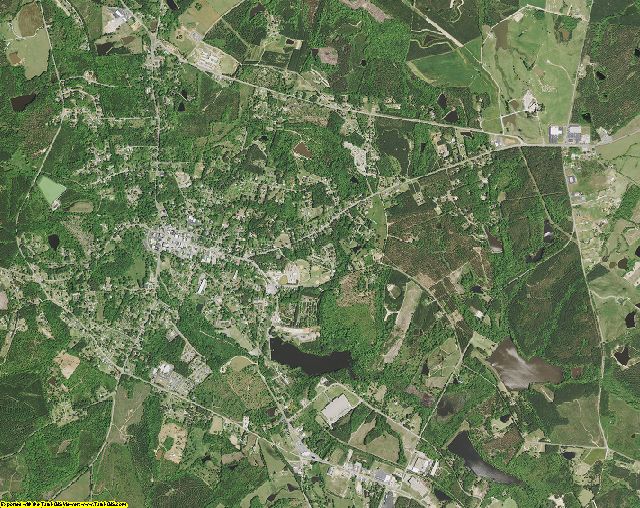

- USDA Rural Construction Loan: When you don’t need to feel an initial-day homebuyer to qualify for that it financing program, will still be a great option for homebuyers of any kind lookin to invest in property within the rural Georgia. It mortgage has the benefit of one hundred% financial support, zero down-payment, and you can 30 year low repaired rate financing, among other things. There are some particular USDA mortgage loans. Finance to possess solitary-nearest and dearest property are for being qualified reduced- and you may reasonable-money individuals. Income limitations differ of the venue and you can house dimensions. You’ll find the income criteria with the USDA’s web site.

- Homes Options Voucher (HCV): Brand new HCV is financed by the HUD and provides assist with low-earnings household to help them changeover out of leasing to help you possessing. To be eligible, applicants should be a recent HCV Participant inside the a beneficial updates. Applicants also needs to meet lowest money requirements and now have continuous complete-date a career to own a-year. Families trying to get so it discount are essential from the HUD and come up with the very least advance payment regarding 3%, with at least step 1% of this percentage via personal tips.

To be eligible for that it taxation borrowing from the bank you must be to invest in property when you look at the a beneficial targeted urban area

- Homestretch Downpayment Recommendations System: New Gwinnett County Government’s Homestretch Deposit Assistance System even offers qualifying first-day homeowners around $seven,five hundred off guidance. Which arrives just like the a zero-interest mortgage with deferred repayments. So you’re able to be considered, homeowners need fulfill certain standards and a beneficial FICO credit history out-of 640 and you may a financial obligation-to-money ratio of 43% or all the way down. Cost limits pertain in addition to achievement out-of a keen 8-hours homebuyer pre-buy classification.

- Georgia Fantasy Homeownership Program: Georgia’s Institution out of Neighborhood Items provides financial assistance so you’re able to homebuyers thanks to the newest Georgia Dream Homeownership System. Being qualified applicants qualify getting advance payment assistance of up to $5,100. Homeowners have to get a property in the a specific city and you may fulfill money and purchase rate limits.

- Georgia Fantasy Toughest Struck Loans (HHF): Created for basic-big date homeowners that experienced monetary demands, the new HHF offers $fifteen,000 for each household while the a forgivable loan without appeal or monthly payments. Immediately after 5 years, the loan is actually forgiven and certainly will be taken to possess deposit otherwise settlement costs. In order to meet the requirements you must inhabit a designated state, possess a credit score from 640 or more, have no felony beliefs in past times a decade, and you also need certainly to secure the financial from the Georgia Dream Homeownership system.

Georgia has the benefit of a tax borrowing to own very first-date homeowners. The newest MCC will assist the fresh new debtor in reducing its federal money tax accountability and you will growing their qualifying money.

Such parts fulfill specific criteria associated with average household members money or had been deemed because the a keen part of chronic financial worry. While doing so, to get experienced an initial-date homebuyer, you simply can’t has actually had possessions since the a primary residence inside past three-years. Discover further limits getting qualifying placed in the latest MCC System Book.

When you find yourself a potential basic-big date homebuyer in the Georgia, you must know there are plenty of programs out there in order to make the techniques basic sensible.

Online Order

Online Order