Sooner or later, the choice out of whether or not to improve your mortgage and for exactly how miss is actually a personal one which depends on individual circumstances. Of the meticulously as a result of the points significantly more than, you may make the best choice you to aligns along with your financial specifications and you will coming plans. We had recommend your talk to one of our knowledgeable mortgage advisors in order to make the decision easier!

Wisdom Debt consolidating

This action can also be clear up your money from the consolidating payments to the you to, possibly lowering your complete interest. For example, car and truck loans, personal loans, and you can charge card debts often hold high rates as compared to lenders, and also make integration an appealing alternative.

Key Considerations having Debt consolidating

In order to combine obligations, you really need to have adequate security of your home. Essentially, you need at least 20% equity left adopting the consolidation. Such as, in the event the house is respected at $500,000 as well as your existing mortgage equilibrium is actually $380,000, you really have $220,000 for the practical security. Which equity is going to be lent to pay off almost every other costs. In the event your security is strictly 20% or faster, financial institutions might not accept the new integration.

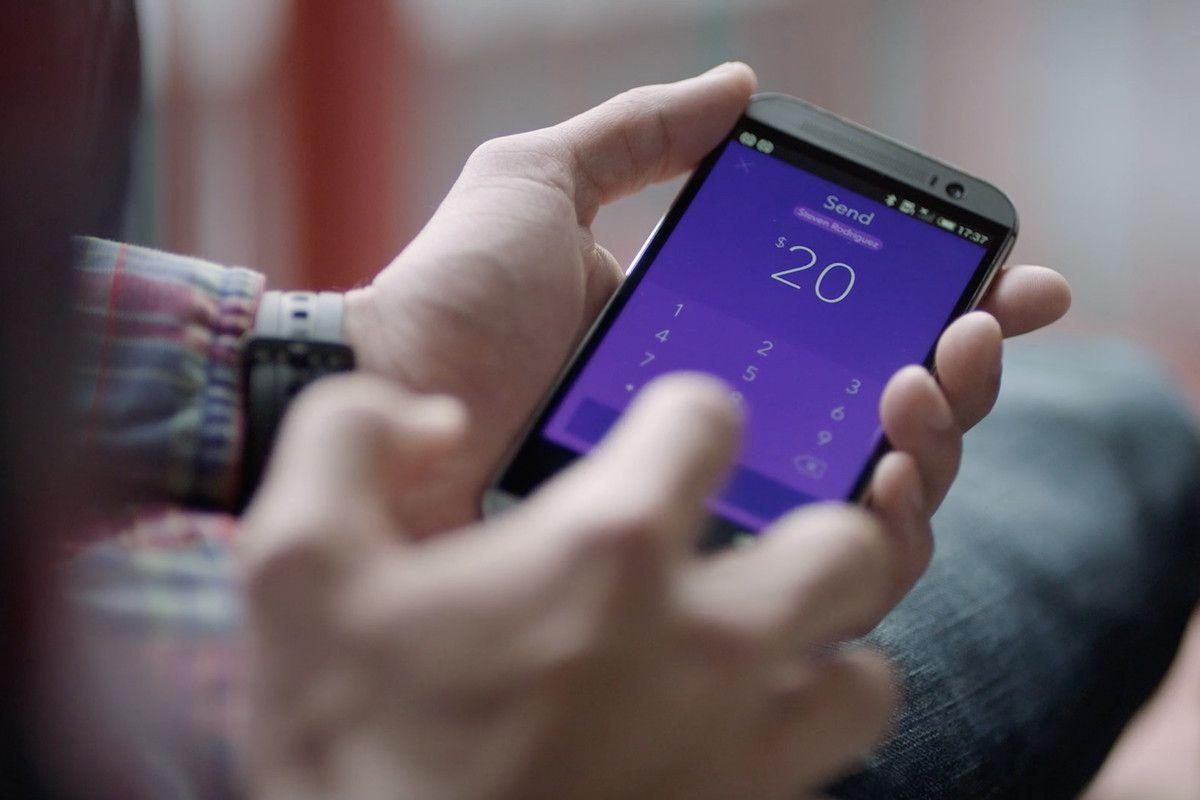

In advance of combining, it is imperative to make certain you can be services the fresh new home loan number. This means evaluating should your earnings is sufficient to shelter the fresh full payments of your own this new, huge home loan. Including, if your latest financial are $380,000 and you’re merging $20,000 in debt, the brand new loan amount could well be $eight hundred,000. You really need to demonstrate that you have enough money for provider the fresh entire $eight hundred,000 financing.

One of the leading benefits associated with debt consolidation was improved bucks move. Existing costs, eg car and truck loans and playing cards, typically have less terms and better interest levels-will ranging from 10% to help you 21%. In contrast, mortgage brokers possess lower rates and you will prolonged terms and conditions, constantly 20 so you’re able to thirty years. This move normally significantly lower your month-to-month money, easing economic stress.

Potential Cons to look at

If you’re merging debt at the a lower life expectancy interest rate decrease your own monthly payments, its necessary to watch out for stretching the loan label. Mortgage brokers typically have an extended cost several months, that may cause paying much more attention over the life of the borrowed funds. By way of example, consolidating a beneficial around three-year car finance into the a thirty-year mortgage can mean you end up spending a lot more into the attract over the future.

To optimize the key benefits of debt consolidating, you might want to keep up if not speeds the cost schedule. For example, if you were purchasing $two hundred weekly to your an effective about three-year car finance, keep to make people money into your financial. This method helps you pay back the debt quicker and you may decreases the entire notice paid.

Important Procedures to possess Debt consolidating

Evaluate Your own Guarantee: Regulate how much equity you have in your home. This should help you recognize how much loans you could potentially combine.

See The money you owe: Make certain you have a steady money and can conveniently service the fresh brand new amount borrowed. Which assessment boasts given your earnings, expenses, and you may present expenses.

Take into account the A lot of time-Title Effect: When you are merging financial obligation can lessen monthly premiums, look at the complete attention you are going to shell out across the lifetime of the borrowed funds. Try to repay the debt as fast as possible to avoid a lot of notice costs.

Search Qualified advice: Seeing a home loan coach helps you navigate the brand new integration processes, making certain it aligns with your financial goals.

Willing to Consolidate The debt?

If you’re considering consolidating personal debt to your home loan, it’s required to know both the gurus and you can prospective issues. Towards best approach, debt consolidating can boost debt balance and you will explain your instalments. To have individualized advice and you may advice inside consolidating your debt, feel free to get in touch. The audience is here in order to create informed decisions and reach financial assurance.

Chance Tolerance: Consider carefully your chance tolerance when selecting the duration of your own financial. An extended-identity repaired-rates home loan could be more pricey in the end if the you’re on a higher level for a longer time, but inaddition it will bring much more stability and predictability. As well, a smaller-term fixed-speed mortgage might have lower total will cost you it is susceptible to interest rate action.

Online Order

Online Order