4. Deals where the consumer more than likely qualifies. To be considered in safer harbor during the (e)(2), the mortgage creator should have a good faith belief that mortgage possibilities made available to the consumer pursuant to (e)(3) are deals where the user more than likely qualifies. The borrowed funds originator’s religion your consumer most likely qualifies would be considering guidance fairly offered to the loan creator from the day the borrowed funds choices are exhibited. To make so it determination, the mortgage creator can get believe in guidance provided by the consumer, even in the event it then is set to-be inaccurate. But rates or any other recommendations that is regularly conveyed by financial institutions in order to loan originators is recognized as being fairly available to the newest mortgage inventor, such, price sheets appearing creditors’ latest cost as well as the requisite minimum borrowing score and other eligibility standards.

36(f) Loan Creator Certification Requirements

step one. Extent. Point (f) sets forward certification requirements you to definitely financing creator must fulfill. Given that provided in the (a)(1) and you may associated reviews, the term mortgage originator boasts pure individuals and you can groups and does not exclude financial institutions to have purposes of the latest qualification standards in (f).

2. Certification and you can membership requirements. payday loans Chunchula Point (f) means financing originators to follow relevant Federal and state certification and membership standards, and additionally these conditions enforced because of the Secure Operate and its particular implementing regulations and you may County legislation. Continue reading Getting reason for (e)(3), a loan inventor is not anticipated to know all areas of for each and every creditor’s underwriting standards

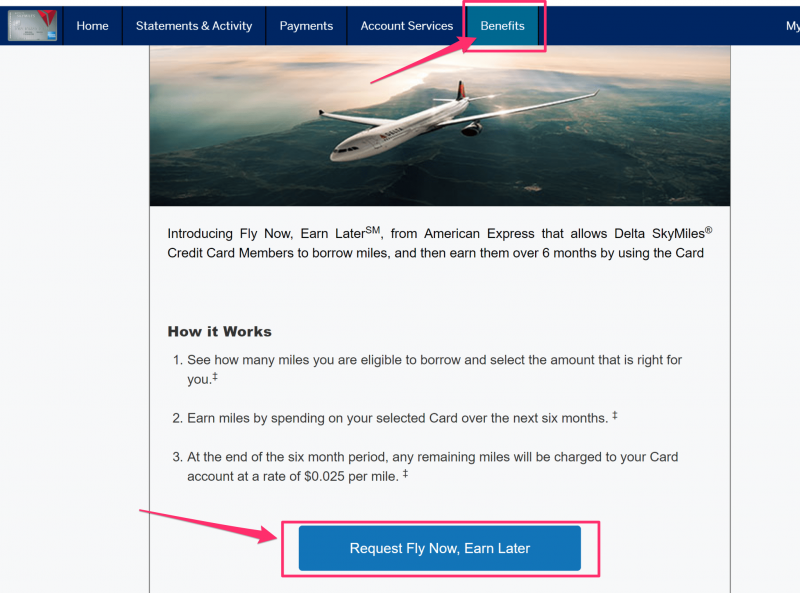

Online Order

Online Order